A public good:

a. is rivalrous in consumption and excludable

b. in nonrivalrous in consumption and nonexcludable

c. must be produces by government

d. both b. and c.

Ans: d. both b. and c.

You might also like to view...

The figure above shows the market for transportation services, which produces an external cost due to the air pollution that is created. Suppose that the government decides to introduce a pollution tax

What is the tax per vehicle mile that will achieve the efficient outcome? A) $2 B) $4 C) $6 D) $8

Refer to Figure 9.3. If the government establishes a price ceiling of $1.00, the resulting deadweight loss will be

A) $1.50. B) $200. C) $150. D) $300. E) $600.

What happens to the price of the product and total revenue for a perfectly competitive firm if it doubles the amount of output it supplies in the market?

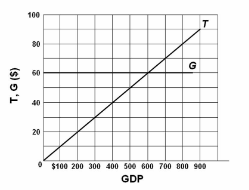

Refer to the diagram, where T is tax revenues and G is government expenditures. All figures are in billions of dollars. If the full-employment GDP and actual GDP are each $400 billion, this economy will realize a:

A. cyclically adjusted deficit of $20 billion.

B. cyclical deficit of $20 billion.

C. cyclical surplus of $20 billion.

D. cyclically adjusted deficit of zero.