Which of the following is not a way that a corporate tax on the income of U.S. car companies will affect markets?

a. The price of cars will rise.

b. The wages of auto workers will fall.

c. Owners of car companies (stockholders) will receive less profit.

d. Less deadweight loss will occur since corporations are entities and not people who respond to incentives.

d

You might also like to view...

In the short-run macro model, if firms produce more output than they sell, those firms will

a. increase the prices of their products b. decrease their output c. increase their output d. cut back on their consumption spending e. increase the prices of their products and reduce the amount of output they produce

Which statement is true?

A. Employment discrimination has ceased to exist. B. Women working full time now earn virtually the same amount as men. C. The poverty rate for blacks and Hispanics is three times the poverty rate for whites. D. Property income is mainly paid in the form of rent.

The distinction between real and nominal rates of interest is understood by

A. most public policy makers. B. the majority of the American population. C. a majority of legislators. D. relatively few Americans.

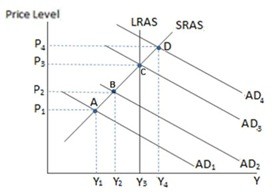

If the economy in the graph shown is currently at point D, we can conclude the:

If the economy in the graph shown is currently at point D, we can conclude the:

A. government may want to enact contractionary fiscal policy. B. unemployment rate is likely very low. C. economy is in an economic boom. D. All of these are likely to be true.