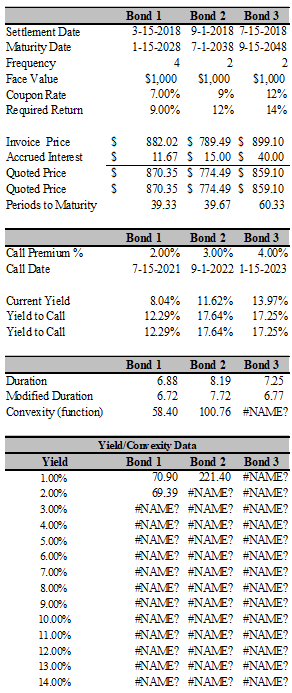

You have decided to evaluate the following bonds to include in your portfolio:

a) Determine the invoice price, the accrued interest, and the quoted price of each bond. Find the quoted price as the difference between the invoice price minus the accrued interest and verify this result using the PRICE function.

b) Determine the yield to call on these bonds if the time to first call and the call premium for each one of them are the following:

f) Determine the duration, modified duration, and convexity of these bonds.

g) Create a chart that shows the relationship of theses bond’s convexity to your required return. Use a range of 1% to 15% in calculating the convexity.

You might also like to view...

David Ricardo's simplified trade model is based on all of these assumptions EXCEPT

a. costs do not vary with the level of production. b. the level of technology is fixed for all nations. c. capital is the only factor of production. d. perfect competition prevails in all markets.

Which is the best definition of scienter?

a. Fraudulent conduct in the purchase of a security. b. A causal connection between a misstatement and a material loss. c. A material omission of facts. d. A wrongful state of mind when making a misrepresentation.

The normal balance of an account is the side (debit or credit) used to decrease the account

Indicate whether the statement is true or false

When using a balanced scorecard, a company's market share is typically classified as an element of the firm's:

A. learning and growth performance measures. B. internal-operations performance measures. C. financial performance measures. D. customer performance measures. E. interdisciplinary performance measures.