Vaden Incorporated makes a single product-a critical part used in commercial airline seats. The company has a standard cost system in which it applies overhead to this product based on the standard labor-hours allowed for the actual output of the period. Data concerning the most recent year appear below: Budgeted (Planned) Overhead: Budgeted variable manufacturing overhead$61,740 Budgeted fixed manufacturing overhead 390,040 Total budgeted manufacturing overhead$451,780 Budgeted production (a) 35,000unitsStandard hours per unit (b) 1.40labor-hoursBudgeted hours (a) × (b) 49,000labor-hours Applying Overhead: Actual production (a) 38,000unitsStandard hours per unit (b) 1.40labor-hoursStandard hours allowed for the actual production (a) ×

(b) 53,200labor-hours Actual Overhead and Hours: Actual variable manufacturing overhead$94,680 Actual fixed manufacturing overhead 405,040 Total actual manufacturing overhead$499,720 Actual hours 52,600labor-hours?The total manufacturing overhead is underapplied or overapplied by how much?

A. $9,216 Overapplied

B. $9,216 Underapplied

C. $47,940 Overapplied

D. $47,940 Underapplied

Answer: B

You might also like to view...

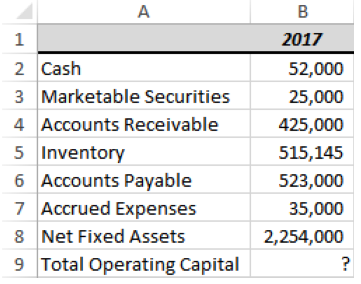

What should be the formula in cell B9?

a) =SUM(B2:B5)-SUM(B6:B7)+B8

b) =B2+SUM(B4:B5)-SUM(B6:B7)+B8

c) =(B2+B4+B5)+B8-(B5+B6 +B7)

d) =(B2+B4+B5)-B8+(B5+B6)

e) =(B2+B4+B5)+B8-(B6+B7)

Describe the responsibilities of a personal representative in the administration of an estate.

What will be an ideal response?

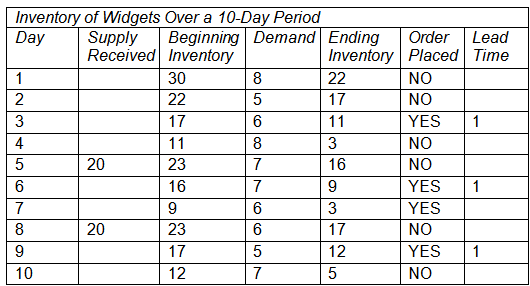

Consider the data on Inventory of Widgets Over a 10-Day Period. Any time that ending inventory falls to 15 or below, an order is placed for 20 units of the product. The lead time for delivery varies and is shown in the column under Lead Time. If the cost of holding inventory is $6 per unit per day, what are the total ordering costs during the 10-day period?

a. $6

b. $115

c. $690

d. $695

Montclair Corporation had current and accumulated E&P of $500,000 at December 31, 20X3. On December 31, the company made a distribution of land to its sole shareholder, Molly Pitcher. The land's fair market value was $200,000 and its tax and E&P basis to Montclair was $50,000. Molly assumed a liability of $25,000 attached to the land. The tax consequences of the distribution to Montclair in 20X3 would be:

A. No gain recognized and a reduction in E&P of $175,000. B. $150,000 gain recognized and a reduction in E&P of $175,000. C. No gain recognized and a reduction in E&P of $200,000. D. $150,000 gain recognized and a reduction in E&P of $200,000.