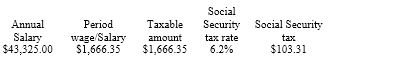

Steve is a full-time exempt employee at a local electricity co-operative. He earns an annual salary of $43,325 and is paid biweekly. What is his Social Security tax deduction for each pay period? (Do not round interim calculations, only round final answer to two decimal points.)

A) $123.95

B) $103.31

C) $98.67

D) $106.34

B) $103.31

You might also like to view...

Assume that the balance of accounts payable does not change during a period. When preparing a statement of cash flows, an increase in ending inventory over beginning inventory will result in an adjustment to net income under the indirect approach because

A) the amount of cost of goods sold is equal to the amount of cash paid for purchases. B) consumed inventory is an expense but not a use of funds. C) the amount of cost of goods sold on an accrual basis is less than the amount of cash paid for purchases of inventory. D) the amount of cash paid for purchases of inventory is less than the amount of cost of goods sold on an accrual basis.

Cash equivalents include

A) checks B) coins and currency C) money market accounts and commercial paper D) stocks and short-term bonds

Drinking alcohol ________ a woman's risk of developing certain types of cancer

a. affects b. effects

Which of the following statements is CORRECT?

A. The NPV method assumes that cash flows will be reinvested at the risk-free rate, while the IRR method assumes reinvestment at the IRR. B. The NPV method assumes that cash flows will be reinvested at the cost of capital, while the IRR method assumes reinvestment at the risk-free rate. C. The NPV method does not consider all relevant cash flows, particularly cash flows beyond the payback period. D. The IRR method does not consider all relevant cash flows, particularly cash flows beyond the payback period. E. The NPV method assumes that cash flows will be reinvested at the cost of capital, while the IRR method assumes reinvestment at the IRR.