You hold a $1,000 bond that has an interest rate of 5 percent. If comparable interest rates rise to 10 percent, and you decide to sell this bond, the price you receive will be

A. $1,000.

B. $500.

C. $2,000.

D. You will not be able to sell the bond since it only pays 5 percent.

Answer: B

You might also like to view...

Assume the total real output of a developing country increases from $8 billion to $8.2 billion while its population expands from 14 to 15 million people from one year to the next. Over the year, real GDP per capita has ________.

A. decreased by $25 per person B. increased by $533 per person C. decreased by $533 per person D. increased by $25 per person

New York Times writer Michael Lewis wrote that "The sad truth, for investors, seems to be that most of the benefits....are passed through to consumers free of charge." To which of the following did Lewis refer?

A) the Enron accounting scandal B) apple farming in New York state C) new technologies developed in the 1990s D) the medical screening industry

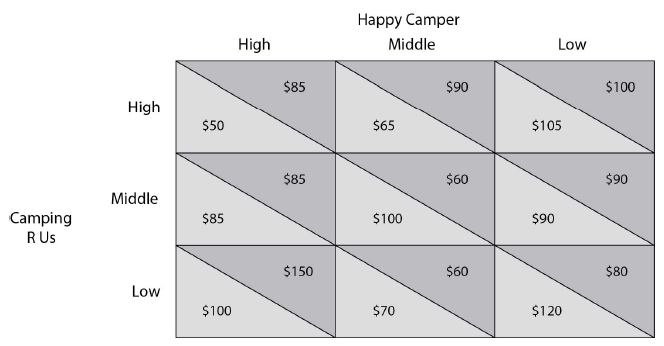

Refer to the payoff matrix below. Which of the following is true for Happy Campers?

A) The Low strategy dominates the Middle strategy

B) The High strategy dominates the Low strategy.

C) The Low strategy dominates the High strategy.

D) The Middle strategy dominates the Low strategy.

Information exchanges operated by sellers are illegal

Indicate whether the statement is true or false