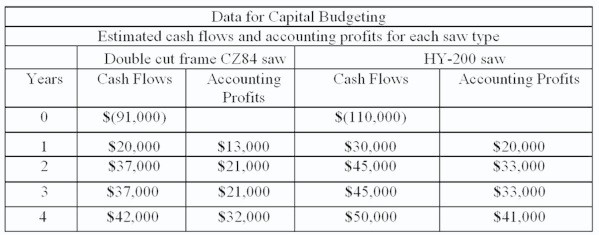

Scenario-JG SawmillsTo meet the high production demand, Jack Wilson-the owner of JG Sawmills-needs to invest in a frame saw. He has narrowed down to two choices: a double cut frame CZ84 saw with chipper and a HY-200 saw with double arbor bearings. The cost of CZ84 will be $91,000, whereas the cost of HY-200 will be $110,000. The salvage value of each type is $0 (zero) and both will have a useful life of 4 years.  Which of the following is one of the advantages of the return on investment (ROI) analysis?

Which of the following is one of the advantages of the return on investment (ROI) analysis?

A. The profits received are the same as cash.

B. It relies on accounting information with which investors are comfortable.

C. The calculations involved in this method are very difficult.

D. It incorporates the time value of money.

Answer: B

You might also like to view...

According to the text, investigation of export and import data shows

A. American firms import twice as much from their overseas subsidiaries than foreign firms import from their U.S. affiliates. B. that American firms, but not Japanese firms, buy from their U.S. subsidiaries. C. there is a strong relationship between global sourcing and ownership of the foreign sources. D. there is no relationship between global sourcing and ownership of the foreign sources.

Domino Company ages its accounts receivable to estimate uncollectible accounts expense. Domino began Year 2 with balances in Accounts Receivable and Allowance for Doubtful Accounts of $76,500 and $5,800, respectively. During Year 2, the company wrote off $4,640 in uncollectible accounts. In preparation for the company's estimate of uncollectible accounts expense for Year 2, Domino prepared the following aging schedule:Number of DaysPast DueReceivablesAmount% Likely to beUncollectibleCurrent $104,000 1% 0-30 45,000 5% 31-60 9,920 10% 61-90 4,440 25% Over 90 3,800 50% Total $167,160 What amount will be reported as uncollectible accounts expense on the Year 2 income statement?

A. $4,640 B. $1,512 C. $7,292 D. $6,132

A company has developed a new cell phone that will be targeted at developing countries. It is estimated that the demand for the new product will initially be slow but would accelerate gradually as the product becomes increasingly familiar to worldwide consumers. In order to determine the number of workers necessary to staff the new production facilities, the company needs to conduct a(n)

A. demand forecast. B. inventory calculation. C. utilization survey. D. market search. E. recruitment drive.

At a time when Blackbird Corporation had E & P of $700,000 and 1,000 shares of stock outstanding, the corporation distributed $300,000 to redeem 400 shares of its stock. The transaction qualified as a disproportionate redemption for the shareholder. Blackbird’s E & P is reduced by $300,000 as a result of the distribution.

Answer the following statement true (T) or false (F)