The asset approach to short-run exchange rate determination relies on which three variables?

a. prices, interest rates, and inflation

b. the reserve ratio, aggregate wealth, and interest rates

c. nominal domestic rates, foreign interest rates, and expectations of exchange rate changes

d. prices, aggregate wealth, and inflation

Ans: c. nominal domestic rates, foreign interest rates, and expectations of exchange rate changes

You might also like to view...

Suppose an investor equally allocates their wealth between a risk-free asset and a risky asset. If the MRS of the current allocation is less than the slope of the budget line, then the investor should:

A) shift more of their wealth to the risky asset. B) shift more of their wealth to the risk-free asset. C) keep the same asset allocation. D) We do not have enough information to answer this question.

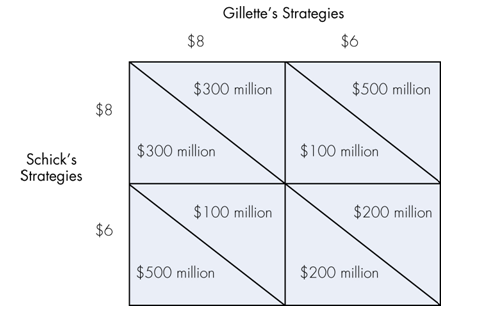

Refer to the table below for an oligopolist’s dilemma. Gillette and Schick are two companies competing in the same oligopoly market. The profit payoff for Gillette is shown in the upper corner of each box, and the profit payoff for Schick is shown in the lower corner of each box. If they cooperate and undertake price collusion the most likely price charged by each firm will be

a. $8 charged by both companies.

b. $6 charged by both companies.

c. $8 charged by Gillette and $6 charged by Schick.

d. $8 charged by Schick and $6 charged by Gillette .

Borrowing VCU3 from an online company cause the nation's:

a. M2 money supply to remain the same. b. M2 money supply to rise. c. M2 money multiplier to rise. d. Monetary base to fall.

The decision about whether to change prices frequently or infrequently is an application of the:

A. cost-benefit principle. B. scarcity principle. C. principle of increasing opportunity cost. D. principle of comparative advantage.