A GDP price index of 100 for a year implies that:

a. there has been no inflation during the year

b. the price level is three times what it was in the base year.

c. the price level is one hundred times what it was in the base year.

d. the price level is double what it was in the base year.

e. the inflation rate has been 100 percent per year since the base year.

b

You might also like to view...

If we look at real and nominal interest rates in the United States since 1971, we see that

A) the real interest rate has almost always been less than the nominal interest rate because of inflation. B) at times the nominal interest rate has been greater than the real interest rate and at times has been less than it. C) the difference between the nominal and real interest rates has widened during the 1990s because of inflation. D) the nominal interest rate has always been less than the real interest rate because of inflation. E) both the nominal and real interest rates were negative in the highly inflationary 1970s.

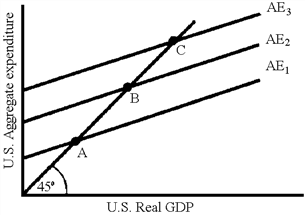

Figure 36-7

?

A. A European economic expansion B. An appreciation of the dollar C. A depreciation of the dollar D. An increase in the money supply

If the adult population in the United States was 225 million people and 150 million of those people were in the labor force, the labor force participation rate would be

A. 40 percent. B. 33 percent. C. 67 percent. D. 150 percent.

According to the rule of 72, a 12% annual increase in real GDP would lead to a doubling of real GDP in 8 years.

a. true b. false