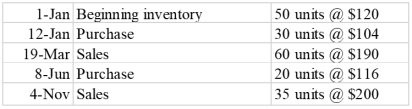

The following transactions apply to Sam's Skateboards.  Assume the use of the perpetual inventory method and that all transactions were for cash. Required: a) Prepare the journal entries for the above transactions, assuming a FIFO cost flow. b) Determine the amount of ending inventory using a FIFO cost flow.

Assume the use of the perpetual inventory method and that all transactions were for cash. Required: a) Prepare the journal entries for the above transactions, assuming a FIFO cost flow. b) Determine the amount of ending inventory using a FIFO cost flow.

What will be an ideal response?

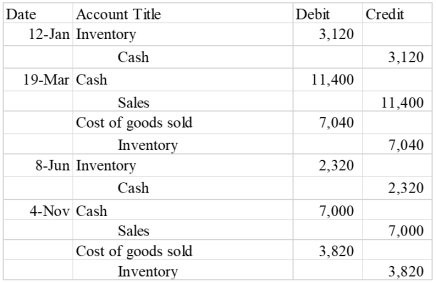

a)

(b) $580

(a)

(b) FIFO Ending Inventory: 5 units × $116 per unit = $580

You might also like to view...

One way to lock in buyers in a free market is to create a situation in which customers fear high switching costs.

Answer the following statement true (T) or false (F)

All of the following statements about corporations are true except

A) they are chartered by the state. B) ownership is represented by shares of stock. C) the sale of stock does not dissolve the business. D) the stockholders have direct control of the business.

Which of the following statements is true of the sources of competitive advantage?

A. The best companies choose one source of competitive advantage and perfect it. B. Trade-offs do not occur among the six sources of competitive advantage. C. It is possible to improve more than one source, but they should be tackled one at a time. D. It is possible to improve quality and also enhance speed. E. When companies improve one source of competitive advantage, others suffer.

Stover Corporation, a U.S. based importer, makes a purchase of crystal glassware from a firm in Switzerland for 39,960 Swiss francs, or $24,000, at the spot rate of 1.665 Swiss francs per dollar. The terms of the purchase are net 90 days, and the U.S. firm wants to cover this trade payable with a forward market hedge to eliminate its exchange rate risk. Suppose the firm completes a forward hedge at the 90-day forward rate of 1.682 Swiss francs. If the spot rate in 90 days is actually 1.615 Swiss francs, how much in U.S. dollars will the U.S. firm have saved or lost by hedging its exchange rate exposure? Do not round the intermediate calculations and round the final answer to the nearest cent.

A. $1,212.29 B. $926.47 C. $985.60 D. $965.89 E. $916.61