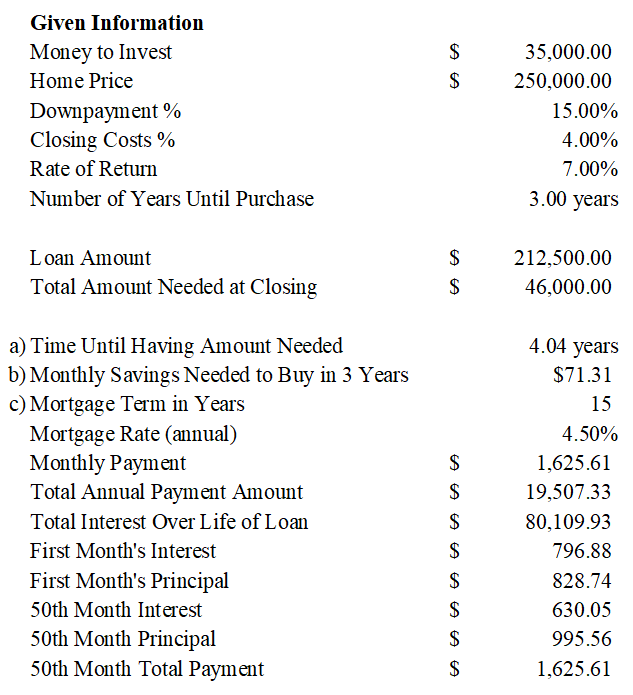

You are planning to buy a new house. You currently have $35,000 and your bank told you that you would need a 15% down payment plus an additional 4% in closing costs. If the house that you want to buy costs $250,000 and you can make a 7% annual return on your investment, determine the following:

a) When will you have enough money for the down payment and closing costs, assuming that the $15,000 is the only investment that you make?

b) You decide that you want to buy the house in 3 years. How much do you need to save every month to achieve your goal?

c) Assume that three years later the house still has the same price and that you can get a 15-year mortgage from your bank at a fixed rate of 4.5%:

1. What are the monthly payments on the loan?

2. How much will you have to pay the bank each year?

3. What is the total interest over the term of the loan?

4. How much do you pay on interest and principal the first monthly payment?

5. How much in the 50th month? (Hint: use the IPMT and PPMT functions)

You might also like to view...

JIT purchasing is successful by employing long-term contracts based on quality, reliability, and price

Indicate whether the statement is true or false

When using the FIFO inventory costing method, ending merchandise inventory will be the highest, as compared to LIFO and weighted-average inventory costing methods, when costs are decreasing

Indicate whether the statement is true or false

When leaving a job, it is customary to give 30 days notice. _________________________

Answer the following statement true (T) or false (F)

When an independent variable is correlated with one other independent variable, the variables are said to be

A) collinear. B) pairwise. C) independent. D) mutually exclusive. E) None of the above