The policy which holds that the federal government should not allow large financial firms to fail, for fear of damaging the financial system, is known as the ________ policy

A) too-big-to-fail B) Dodd-Frank

C) mandatory bailout D) rational expectations

A

You might also like to view...

Which of the following is not a characteristic of a perfectly competitive market?

a. Firms are price takers. b. Firms have difficulty entering the market. c. There are many sellers in the market. d. Goods offered for sale are largely the same.

Which of the following shifts aggregate demand to the right?

a. a decrease in the money supply b. increases in the profitability of capital due perhaps to technological progress. c. the repeal of an investment tax credit d. a decrease in the price level

Sometimes a change in the real effective multilateral exchange rate has the opposite result from what one would expect. One explanation may be:

a. that buying habits are very strong and firms and consumers continue their behavior despite large changes in prices of imports. b. that price changes do not bring about immediate responses in import or export volume because of contracts, or firms' difficulty in changing suppliers quickly. c. that the theory is fundamentally flawed and does not predict well. d. that there are other factors we are not considering that affect the trade balance.

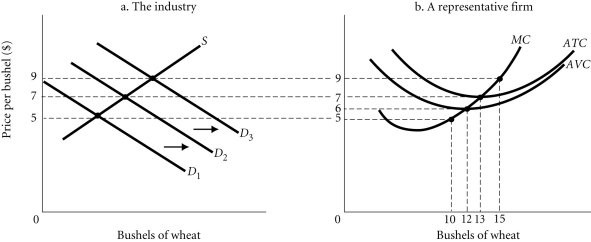

Refer to the information provided in Figure 9.2 below to answer the question(s) that follow. Figure 9.2Refer to Figure 9.2. Suppose demand for wheat is initially D2. If the price of rice (a substitute for wheat) falls, then demand for wheat will shift to ________. This will ________ the equilibrium price of wheat, and individual profit-maximizing firms will produce ________ bushels of wheat.

Figure 9.2Refer to Figure 9.2. Suppose demand for wheat is initially D2. If the price of rice (a substitute for wheat) falls, then demand for wheat will shift to ________. This will ________ the equilibrium price of wheat, and individual profit-maximizing firms will produce ________ bushels of wheat.

A. D1; decrease; 0 B. D3; decrease; 10 C. D3; increase; 15 D. D1; increase; 13