In 2015, the U.S. personal income tax system consisted of the following tax rates:

A. 5%, 10%, 15%, 20%, 25%, and 30%.

B. 5%, 10%, 15%, 25%, 30%, and 35%.

C. 10%, 20%, 30%, 40%, 55%, and 69%.

D. 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%.

Answer: D

You might also like to view...

For a given supply elasticity, the more inelastic the demand for a good, the larger the share of the tax paid by the

A) buyers. B) sellers. C) participants other than the buyers and sellers. D) government. E) None of the above answers is correct.

Households will choose to save more if

A) income is expected to decrease in the future. B) current disposable income increases. C) Both answers A and B are correct. D) Neither answer A nor B is correct.

The U.S. demand for euros is:

A. downsloping because, at lower dollar prices for euros, Americans will want to buy more European goods and services. B. downsloping because, at higher dollar prices for euros, Americans will want to buy more European goods and services. C. downsloping because the dollar price of euros and the euro price of dollars are directly related. D. upsloping because a higher dollar price of euros makes European goods and services more attractive to Americans.

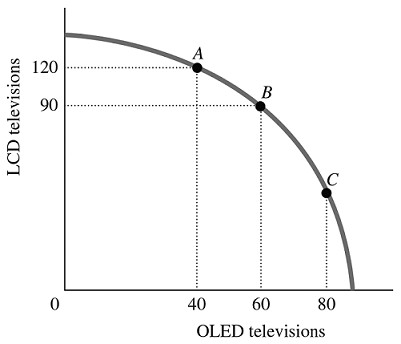

Refer to the information provided in Figure 2.5 below to answer the question(s) that follow. Figure 2.5Refer to Figure 2.5. For this economy to move from Point A to Point B, ________ additional OLED TVs could be produced when the production of LCD TVs is reduced by 30.

Figure 2.5Refer to Figure 2.5. For this economy to move from Point A to Point B, ________ additional OLED TVs could be produced when the production of LCD TVs is reduced by 30.

A. exactly 20 B. more than 20 C. fewer than 20 D. exactly 90