How does a firm raise external funds through direct finance?

What will be an ideal response?

With direct finance, funds flow from savers to firms, via the sale of stock or bonds, through financial markets, such as the New York Stock Exchange.

You might also like to view...

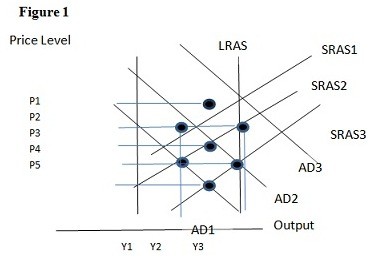

Using Figure 1 above, if the aggregate demand curve shifts from AD3 to AD2 the result in the short run would be:

A. P3 and Y1. B. P2 and Y1. C. P2 and Y3. D. P1 and Y2.

When PAE decreases then the economy will move towards:

A. lower levels of equilibrium GDP. B. higher levels of equilibrium GDP. C. constant levels of GDP. D. higher levels of equilibrium aggregate expenditure.

If corporate profits increase rapidly, the main beneficiaries are its

a. common stockholders b. managers c. bondholders d. preferred stockholders e. convertible stockholders

The Coase theorem suggests that private solutions to an externality problem

a. are effective under all conditions. b. will usually allocate resources efficiently if private parties can bargain without cost. c. are only efficient when there are negative externalities. d. may not be possible because of the distribution of property rights.