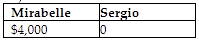

Mirabelle contributed land with a $5,000 basis and a $9,000 FMV to MS Partnership four years ago. This year the land is distributed to Sergio, another partner in the partnership. At the time of distribution, the land had a $12,000 FMV. How much gain should Mirabelle and Sergio recognize?

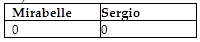

A)

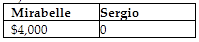

B)

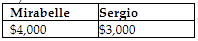

C)

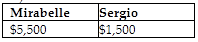

D)

B)

You might also like to view...

The accounts payable subsidiary ledger ________.

A) does not indicate the amount owed to each vendor B) shows only a single total for the amount owed on account C) lists vendors in alphabetical order, along with amounts paid to the vendors and the remaining amounts owed to them D) has a format that is entirely different from an accounts receivable subsidiary ledger

Discuss the indirect and direct methods in deriving cash flow from operations

In a short essay, list and discuss any three of the five issues that managers have to consider when deriving an ethical policy for information technology.

What will be an ideal response?

Today, a manager is usually a leadership role in the entry level jobs of an organization hierarchy who is responsible for supervision and administration.

a. True b. False