How does a change in taxes primarily affect aggregate demand?

a. A tax change alters exports and net exports

b. A tax change alters investment by an equal and opposite amount.

c. A tax change alters disposable income and consumption spending.

d. A tax change alters government purchases by an equal amount.

c

You might also like to view...

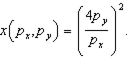

Suppose the demand function for a consumer is given by

What will be an ideal response?

The decrease in the value of the dollar relative to the Japanese yen

A. increased the yen price paid and decreased the dollar price received from U.S. goods exported to Japan. B. decreased both the yen price paid and the dollar price received from U.S. goods exported to Japan. C. increased both the yen price paid and the dollar price received from U.S. goods exported to Japan. D. decreased the yen price paid and increased the dollar price received from U.S. goods exported to Japan.

The higher the transaction cost of an exchange, the lower the probability of the exchange taking place between the buyer and the seller

Indicate whether the statement is true or false

All Union Bank pays $120,000 from its reserves to buy the corporate bonds of a leading real estate firm from Smith and Kim Bank. Smith and Kim Bank keeps the amount in its vault as reserves. In the given scenario, which of the following statements is true? a. $120,000 will be added as an asset for Smith and Kim Bank, while $120,000 will be added as a liability for All Union Bank. b. $120,000

will be added as a liability for Smith and Kim Bank, while $120,000 will be added as an asset for All Union Bank. c. The liabilities of both Smith and Kim Bank and All Union Bank will increase by $120,000. d. There will be no change in the value of assets or liabilities of both the banks.