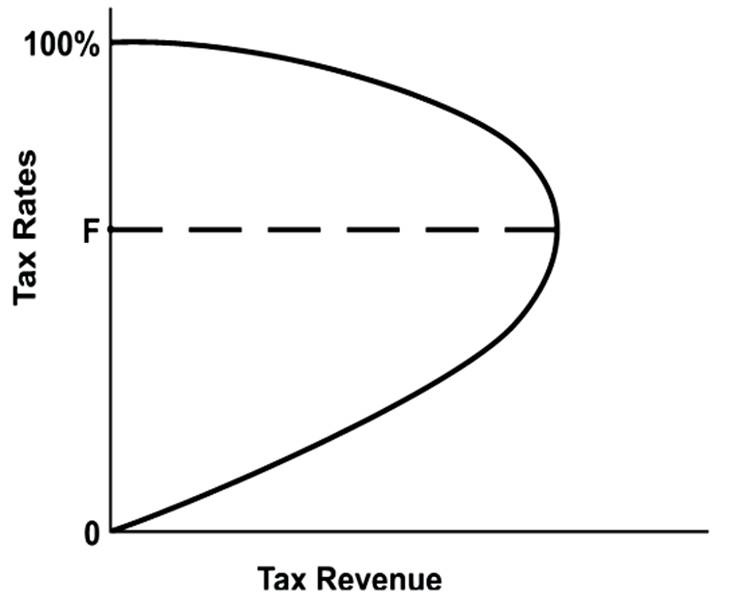

Supply-side economists would say that tax rates are generally

A. at the level 0F.

B. at some level below 0F.

C. at some level above 0F.

D. such that an increase in tax rates will increase tax revenue.

C. at some level above 0F.

You might also like to view...

Clarke Mementos manufactures small figurines that they sell to retailers around the country. Clarke sells the figurines for $5.00 each, a price the firm considers given. Clarke's production function is given by the expression:

Q = 60L - 0.5L2, where Q = number of figurines per day, and L = number of skilled workers per day. Based on this production function, the average and marginal products of labor are as follows: AP = 60 - 0.5L MP = 60 - L a. Write an expression for the firm's marginal revenue product. b. Clarke currently pays $150 per day (including fringe benefits) for each of its skilled workers. How many workers should the firm employ? c. Clarke's workers are highly skilled artisans with a great deal of job mobility. The firm's managers fear that they must increase the workers' total compensation to $200 per day to remain competitive. What impact would the wage increase have upon the firm's employment?

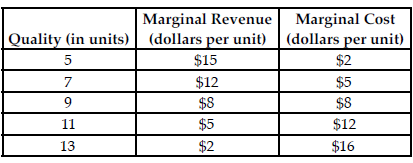

Refer to the table below. If Stuffed Pies is currently producing 5 units of quality, to maximize profit, Stuffed Pies should ________ the units of quality.

Stuffed Pies is a frozen calzone manufacturer. The table above summarizes Stuffed Pies' marginal revenue and marginal cost of quality at various quality amounts.

A) decrease

B) not change

C) increase

D) decrease by 50 percent

If the expected rate of return decreases

A. The demand for loanable funds will increase. B. The demand for loanable funds will decrease. C. The time value of money will increase. D. Market participants will save less money.

Suppose that the prices of dairy products have risen relatively less than prices in general over the last several years. To which problem in the construction of the CPI is this situation most relevant?

a. substitution bias b. introduction of new goods c. unmeasured quality change d. income bias