The concept of “random walk” applies most closely to forecasts of

A. consumer demand for a product after a price increase.

B. the effects of a tax on the supply of oil.

C. the effects of transfer payments on labor supply.

D. the price of a particular stock one year from now.

Answer: D

You might also like to view...

Assume that the expectation of declining housing prices cause households to reduce their demand for new houses and the financing that accompanies it. If the nation has low mobility international capital markets and a flexible exchange rate system, what happens to the real risk-free interest rate and real GDP in the context of the Three-Sector-Model?

a. The real risk-free interest rate falls, and real GDP rises. b. The real risk-free interest rate rises, and real GDP remains the same. c. The real risk-free interest rate and real GDP remain the same. d. The real risk-free interest rate falls, and real GDP falls. e. There is not enough information to determine what happens to these two macroeconomic variables.

Why does the theory of efficient markets imply that stock price movements are unpredictable?

What will be an ideal response?

The market for microcomputers (PCs) is fairly competitive and the products are somewhat homogeneous. Over time, new firms have entered the market to make profit on new configurations of the microcomputer, and profits

A. have become razor thin for many producers. B. have stayed the same for most firms. C. have not influenced the decisions of the firms D. have risen dramatically.

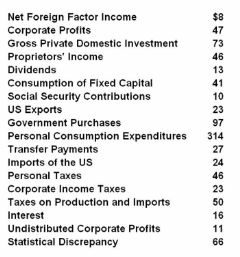

The following national income statistics are in billions of dollars

Refer to the above data. Net domestic product is:

A.

$400 billion

B.

$442 billion

C.

$483 billion

D.

$517 billion