Which statement is true?

A. The federal personal income tax is a proportional tax.

B. The cigarette tax is an excise tax.

C. The tax on gasoline is a direct tax.

D. None of these statements are true.

B. The cigarette tax is an excise tax.

You might also like to view...

Which of the following statements regarding a price-taking firm is correct?

A) Demand = average revenue > marginal revenue. B) Demand = marginal revenue > average revenue. C) Demand = price = average revenue = marginal revenue. D) Demand = price > average revenue > marginal revenue.

What is the relationship between the long-run industry supply curve and the short-run supply curve in a perfectly competitive market?

What will be an ideal response?

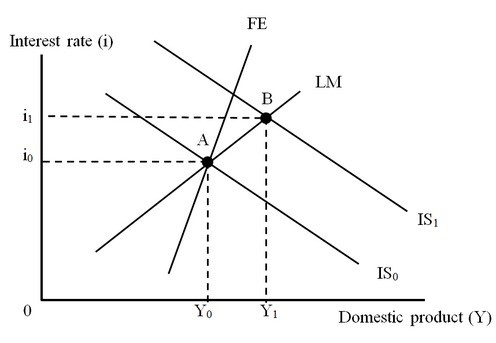

The figure below shows an IS-LM-FE model for an economy with fixed exchange rates. Initially the economy is at Point A, a triple intersection. Here, the FE curve is steeper than the LM curve. At Point B, the economy is experiencing

At Point B, the economy is experiencing

A. an overall balance of payments that is in equilibrium. B. a surplus in the overall balance of payments. C. an expanding money supply. D. a deficit in the overall balance of payments.

________: the variable costs incurred by the business in the current period per unit of output

Fill in the blank(s) with correct word