Which of the following is true of International Banking Facilities (IBFs) in the U.S.?

a. IBFs were legalized by the Federal Reserve Board in 1970.

b. IBFs are bookkeeping systems set up in existing bank offices of the U.S. to record international banking transactions

c. IBFs are "shell" bank branches of U.S. banks in the Caribbean.

d. Loans extended by the IBFs are subject to reserve requirements and interest rate regulations.

e. IBFs are allowed to extend loans to the residents and businesses of the United States and not to the nonresidents.

b

You might also like to view...

How is a monopolistically competitive firm similar to a perfectly competitive firm?

A) Both will observe entry into the industry if economic profit is positive. B) Both produce where average total cost equals marginal cost. C) Both make a positive economic profit in the long run. D) Both produce a homogeneous good.

Other things constant, if the Fed decreased the discount rate,

a. the earnings of the Fed would increase. b. the incentive of commercial banks to borrow from the Fed would be reduced. c. borrowing from the Fed will tend to increase and the money supply will tend to expand. d. borrowing from the Fed will tend to decrease and the money supply will tend to decline.

Which of the following is true about business cycles in the United States?

A. They vary greatly in length, frequency, and intensity. B. They are remarkably similar in length but vary greatly in intensity. C. They are similar in length, frequency, and intensity. D. They are similar in frequency and intensity but not in length.

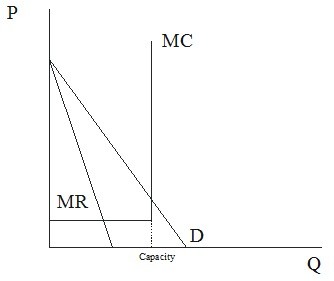

Referring to Figure 34.1, the price that this promoter will choose will  Figure 34.1

Figure 34.1

A. sell out the facility. B. be where the demand curve crosses the marginal cost curve. C. be such that there are many empty seats. D. be less than the marginal revenue.