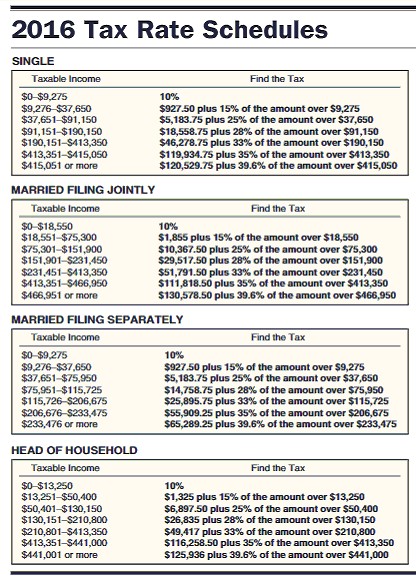

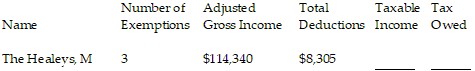

Find the amount of taxable income and the tax owed for the following people. The letter following the name indicates the marital status and all married people are filing jointly. Use $4050 for each personal exemption; $6300 as the standard deduction for single taxpayers, $12,600 for married taxpayers filing jointly, and $9300 for head of household and the following tax rate schedule.

A. $89,590; $13,940.00

B. $97,440; $16,610.00

C. $91,640; $15,839.20

D. $81,285; $15,013.75

Answer: A

You might also like to view...

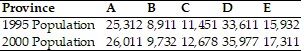

Determine whether the specified paradox occurs.In a small country consisting of 5 provinces, 300 federal judges are apportioned according to the population of each province. The population of each province is shown for the years 1995 and 2000.  Does the population paradox occur using Hamilton's method of apportionment?

Does the population paradox occur using Hamilton's method of apportionment?

A. Yes B. No

Find the vertices of the ellipse.16x2 - 160x + 25y2 + 250y + 625 = 0

A. (-5, 0), (-5, 10) B. (0, -5), (10, -5) C. (2, -5), (8, -5) D. (1, -5), (9, -5)

Decide whether the relation defines a function.y =

A. Function B. Not a function

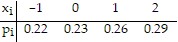

Provide an appropriate response.The probability distribution for the random variable X is:  What is the expected value of X?

What is the expected value of X?

A. 0.62 B. 0.26 C. 0.22 D. 0.50