If an investment requires payment of $5,000 now and promises to return a single payout of $15,000 one year from now, the net present value of the investment at an interest rate of 10% is approximately

A. $13,636.

B. $10,000.

C. $3,636.

D. $8,636.

Answer: D

You might also like to view...

Health insurance plans which typically reimburse doctors mainly by paying ________ are known as health maintenance organizations

A) an escalating fee based on the number of patients being treated B) a fee for each individual service provided C) a fee for each individual office visit D) a flat fee per patient

Indexation is designed to

A) moderate the costs of inflation, not inflation itself. B) rapidly reduce inflation. C) reduce the natural rate of unemployment. D) rapidly reduce inflationary expectations.

The possible returns to a shareholder are:

a. rent and wages. b. fixed interest and dividend. c. fixed interest and a depreciation in the price of the stock. d. rent and fixed interest. e. dividend and an appreciation in the price of the stock.

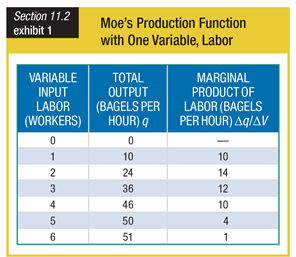

Explain why the marginal product of labor shown in Moe’s Production Function with One Variable, Labor, is higher with two employees than it is with six.

What will be an ideal response?