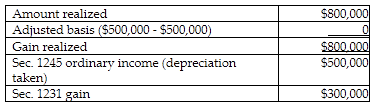

Alejandro purchased a building in 1985, which he uses in his manufacturing business. Alejandro used the ACRS statutory rates to determine the cost-recovery deduction for the building. Alejandro's original cost for the building is $500,000 and cost-recovery deductions allowed are $500,000. If the building is sold for $800,000, the tax results to Alejandro are

A) $500,000 Sec. 1245 ordinary income and $300,000 Sec. 1231 gain.

B) $800,000 Sec. 1245 ordinary income.

C) $500,000 Sec. 1245 ordinary income and $300,000 Sec. 1250 income.

D) $800,000 Sec. 1231 gain.

A) $500,000 Sec. 1245 ordinary income and $300,000 Sec. 1231 gain.

Section 1245 ordinary income recapture applies to non-residential real estate placed in service after December 31, 1980, and before January 1, 1987. This property qualifies as such. Gain realized is considered 1245 ordinary income to the extent of all depreciation taken, with any remaining gain treated as Sec. 1231 gain.

You might also like to view...

______ breeds mistrust and further deception; these are factors harmful to the building of strong relationships.

Fill in the blank(s) with the appropriate word(s).

Judging a theory by observing evidence rather than simply by its internal logic is called:

a. subjective reasoning. b. inductive reasoning. c. deductive reasoning. d. objective reasoning.

The typical activities of project oversight cover two dimensions. Reviewing project objectives and resolving project bottlenecks are typical activities at the ________ level of project oversight.

Fill in the blank(s) with the appropriate word(s).

The phenomenon called ______ often occurs when there is a concentration of critical resources in a particular region.

a. clustering b. grouping c. categorization d. classification