If your taxable income rises from $35,000 to $45,000, and the taxes you pay rise from $12,000 to $15,000, your marginal tax rate is

A. 10 percent.

B. 20 percent.

C. 30 percent.

D. 40 percent.

E. Impossible to determine.

C. 30 percent.

You might also like to view...

An increase in supply will cause the equilibrium price to ________ and the equilibrium quantity to ________

A) increase; increase B) increase; decrease C) decrease; increase D) decrease; decrease

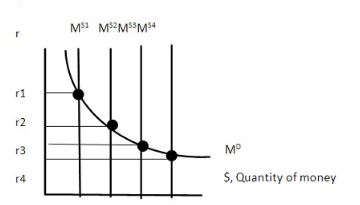

If the money supply in the economy were at MS3, to engage in expansionary policy the Federal Reserve Bank would use open market operation to move money supply to:

A. MS1

B. MS2

C. MS4

D. it would stay at MS3

Everything else constant, who is least likely to lose from unexpected inflation?

a. A retired person whose pension payments are fixed in dollars b. A person with a large amount of money deposited in a savings account c. A bank scheduled to receive fixed nominal mortgage payments d. A homeowner scheduled to make fixed nominal mortgage payments e. A consumer who spends extra time shopping for the lowest prices

Carlos uses a company's blog to announce new merchandise, get feedback from customers, and allow customers to share information about his products. His frequent customers use his his blog on a regular basis to keep up with what is happening with the company's products and to share product preferences. This is called