Assume that the United States levies a high tariff against Japanese steel. How is the tariff likely to affect a. U.S. steel workers? b. General Motors? c. Bethlehem Steel? d. Japanese automobile producers? e. U.S. electric utilities?

What will be an ideal response?

a. U.S. steel workers will benefit through continued employment and high wages.

b. As a purchaser of steel, General Motors will be worse off because it will pay more for the steel it uses in producing automobiles. As a competitor with Japanese car manufacturers, it will be worse off because the steel costs for the latter will actually go down.

c. Bethlehem Steel will be better off because it will be protected against foreign competition.

d. Japanese automobile producers will be better off because the price of Japanese steel will be lower (because of increased supply).

e. U.S. electric utilities will be better off because of the increased demand for electric power by U.S. steel producers, but worse off because of decreased demand by U.S. firms that buy steel.

You might also like to view...

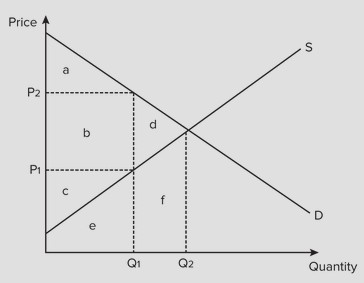

Use the figure below to answer the following question. If actual production and consumption occur at Q1 and the price is P1

If actual production and consumption occur at Q1 and the price is P1

A. deadweight loss equals area b. B. producer surplus equals area c + b. C. consumer surplus equals area a + b. D. consumer surplus equals area a.

Assume that two firms in an oligopoly market are unable to collude. Once the Nash Equilibrium is reached a. it is always possible for one firm to increase its profits by producing more output. b. the two firms are jointly earning monopoly profit

c. neither firm is able to improve its outcome on its own. d. the outcome is equivalent to a competitive equilibrium.

The cost of repositioning an automobile gas tank for greater safety is $11 per vehicle for 12.5 million vehicles. It is expected that 180 deaths will occur if the gas tank location is not redesigned. If a human life can be valued at $500,000, the expected benefit of redesigning the location of the gas tank is:

A. $900,000,000. B. $550,000,000. C. $90,000,000. D. $5,500,000.

Which of the following is most likely an example of constant returns to scale?

A. Alpha-Beta Inc. raised its price 10 percent after a 5 percent increase in production costs. B. The XYZ Co. increased production 25 percent and experienced a 30 percent increase in its total cost. C. The per-unit costs of Excel Publishing Company's manuals fell after a large order was received from the government. D. Widget Manufacturing doubled its production by opening a new plant that was identical to its old plant.