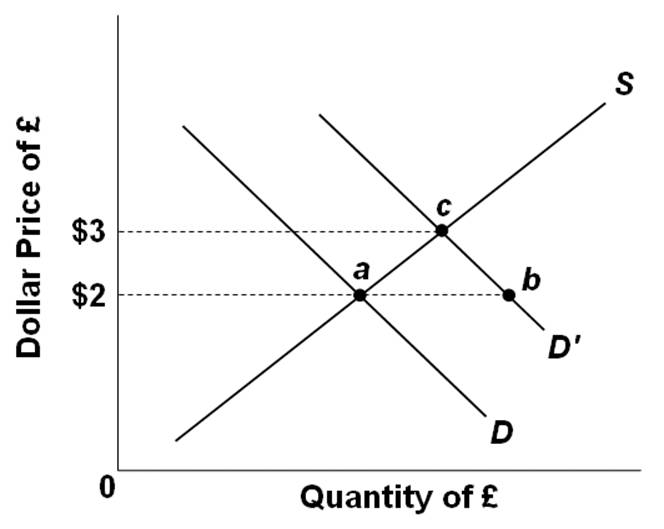

Refer to the graph below, which shows a change in the demand for pounds from D to D'. Under a system of flexible exchange rates, the:

A. Price of a pound will increase to $3

B. Price of a dollar will increase to 3 pounds

C. Shortage equal to ab would be met using international monetary reserves

D. Payment deficit will cause changes in domestic price and income levels, shifting demand to the left, supply to the right, and reestablishing the original exchange rate

A. Price of a pound will increase to $3

You might also like to view...

In monopolistic competition, in the long run customers pay a price that is

A) less than the minimum ATC. B) more than the minimum ATC. C) equal to both the minimum ATC and the minimum AVC. D) equal to the minimum ATC, but not equal to the minimum AVC.

Which of the following will increase aggregate demand in the United States?

a. A higher price level. b. An increase in the real interest rate. c. An increase in wealth due to a substantial appreciation in the value of stocks. d. A decrease in real income in Japan and Western Europe.

If monetary policymakers cannot accurately forecast shifts in money demand, what are they really only left with for a short-term policy instrument and why?

What will be an ideal response?

If the government presets a price that turns out to be above the actual equilibrium price, a surplus will develop in the market.

Answer the following statement true (T) or false (F)