Raul has an adjusted income of $153,850, is married, and files jointly. Compute his tax.

?

Revised 2003 Tax Rate SchedulesIf TAXABLE INCOMEThe TAX is Is OverBut Not OverThis AmountPlusThis %Of theExcess OverSCHEDULE Y-1 -Married Filing Jointlyor Qualifying Widow(er)$0$14,000$0.0010%$0.00$14,000$56,800$1,400.0015%$14,000$56,800$114,650$7,820.0025%$56,800$114,650$174,700$22,282.5028%$114,650$174,700$311,950$39,096.5033%$174,700$311,950-$84,389.0035%$311,950?

A. $32,082.50

B. $10,976.00

C. $33,258.50

D. $22,282.50

E. $22,377.50

Answer: C

Mathematics

You might also like to view...

Solve the equation.| n + 2| = |

n + 2| = | n - 2|

n - 2|

A. 0 B. 16, 12 C. No solution D. 16, 0

Mathematics

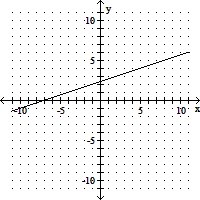

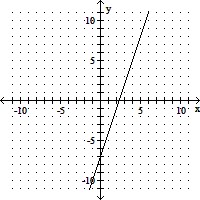

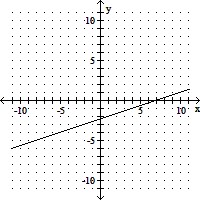

Graph the equation.3y = x - 7

A.

B.

C.

D.

Mathematics

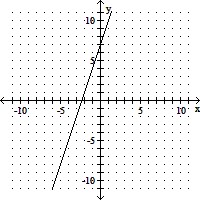

For the given graphical representation of vector v, estimate a1 and a2 so that  and calculate

and calculate  .

.

A. a1 = 10, a2 = 8;  = 12.8

= 12.8

B. a1 = 8, a2 = -10;  = 12.8

= 12.8

C. a1 = 10 a2 = 8;  = 164

= 164

D. a1 = -10, a2 = 8;  = 12.8

= 12.8

Mathematics

Evaluate the definite integral.

Mathematics