Suppose Dean has $500 and there are two companies he could invest X dollars in: Dog Gone Salon, which has a payoff of 2X with 50% probability and $0 with 50% probability and Pretty Kitty Grooming, which has a payoff of 4X with 25% probability and $0 with 75% probability. Dean's expected payoff from investing in Pretty Kitty Grooming only is:

A. $500.

B. $2,000.

C. $1,000.

D. $1,500.

A. $500.

You might also like to view...

Refer to Figure 3-2. A decrease in the price of inputs would be represented by a movement from

A) A to B. B) B to A. C) S1 to S2. D) S2 to S1.

Illustrate graphically the effect the credit market crisis in the United States in 2008 had in the market for existing single-family homes

Assuming the demand for existing single-family homes is relatively inelastic, what is likely to happen to the total revenues of home sellers as a result of the credit market crisis?

We associate the term debt finance with

a. the bond market, and we associate the term equity finance with the stock market. b. the stock market, and we associate the term equity finance with the bond market. c. financial intermediaries, and we associate the term equity finance with financial markets. d. financial markets, and we associate the term equity finance with financial intermediaries.

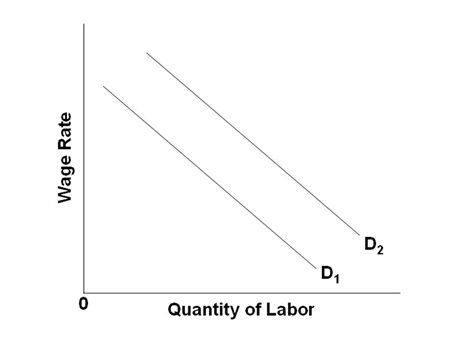

Refer to the below graph. What will shift D1 to D2?

Use the following graph to answer question about the labor resource market faced by producers of good X:

A. An increase in the price of a substitute input (if the output effect > substitution effect)

B. A decrease in the price of a substitute input (if the substitution effect > output effect)

C. A decrease in the price of a substitute input (if the output effect > substitution effect)

D. An increase in the price of a complementary resource