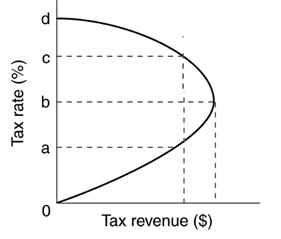

Suppose an the government has a current tax rate of c. Knowing the Laffer Curve is depicted below advise the president on whether the tax rate should be increased, decreased, or remain the same.

As an advisory to the president, you should recommend that the tax rate be reduced for two reasons. First, decreasing the tax rate will increase tax revenue. Tax revenue will increase up to the tax rate of b, at which point the tax revenue will begin to decline again. The other reason the tax rate should be reduce is that the same tax revenue would be generated at rate a with fewer distortions to the market. If the level of revenue to the government hopes to raise is its current level, the economy would be closer the efficient level at rate a.

You might also like to view...

Starting from long-run equilibrium, a decrease in autonomous investment results in ________ output in the short run and ________ output in the long run.

A. lower; potential B. higher; higher C. higher; potential D. lower; higher

A government-imposed price floor has what effect on efficiency?

A. Consumer surplus increases. B. There is little dead weight loss. C. Consumer and producer surplus increases. D. Producer surplus increases.

Dumping occurs when, in a foreign market, a good is sold

A) below its cost of production or below the price in that market. B) at a discount below the list price. C) below its nominal price. D) at a price above the equilibrium price.

Which of the following is an example of fiscal tightening? # randomize

A. Business spending more because they are more optimistic about the economy B. Consumers spending more because they expect high income in future C. Foreigners buying more local goods because of higher income D. Government reducing the size of its deficit E. Central bank raising interest rates to fight inflation