When accounting for a cash flow hedge of a recognized asset or liability, which of the following is/are true?

a. If the derivative is not highly effective in neutralizing the gain or loss on the hedged item, then the firm must reclassify the ineffective portion to net income immediately and not wait until the gain or loss on the hedged items affects net income.

b. The firm reports the hedged asset and liability and the hedging instrument separately on the balance sheet and the cumulative amount of net changes in fair value of the hedging instrument in accumulated other comprehensive income.

c. The firm removes the hedged asset or liability and its related derivative from the accounts at the time of settlement.

d. The firm reclassifies gains and losses from other comprehensive income to net income when the gain or loss on the hedged item affects net income.

e. all of the above.

E

You might also like to view...

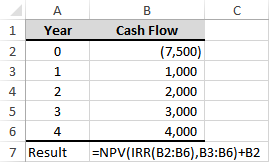

What is the result in B7?

a) 2,316.35

b) 27.27%

c) -2,316.35

d) -14.36%

e) 0

________ serve as visible markers to flaunt membership in higher social classes

A) Heuristics B) Psychographics C) Status symbols D) Reference groups E) Attitudes

Duck Insurance Company received advance payments from customers during 2012 of $100,000. At December 31, 2012, $15,000 of the advance payments still had not been earned. After the adjustments are recorded and posted at December 31, 2012, what will the balances be in the Unearned Insurance Revenue and Insurance Revenue accounts? Unearned Insurance Revenue Insurance Revenue

A) $ 85,000 $ 15,000 B) $ 0 $100,000 C) $ 15,000 $ 15,000 D) $ 15,000 $ 85,000

In a ______ structure, a requirement is that the organization maintains dual perspectives, with employees reporting directly to the two bosses that manage these dual perspectives.

a. functional b. unit c. matrix d. network