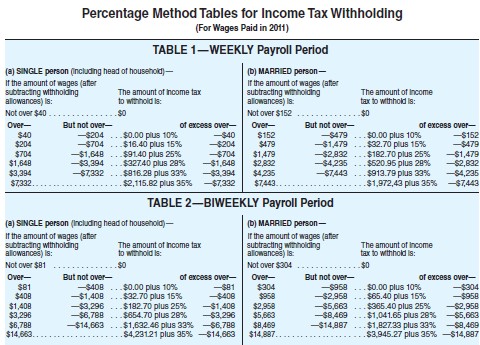

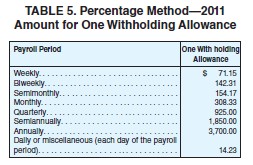

Use the percentage method of withholding to find the federal withholding tax, a 6.2% FICA rate to find the FICA tax, and 1.45% to find the Medicare tax. Then find the net pay for the employee. Assume that the employee has not earned over $110,000 so far this year.

Karen Smith has gross earnings of $21,312.15 monthly. She is married and has 2 withholding allowances.

Karen Smith has gross earnings of $21,312.15 monthly. She is married and has 2 withholding allowances.

A. $16,578.62

B. $14,948.24

C. $24,415.30

D. $19,681.77

Answer: B

You might also like to view...

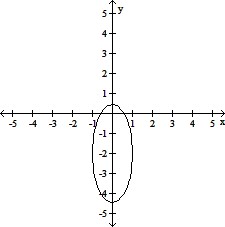

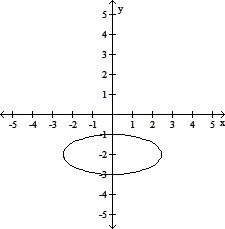

The equation of an ellipse is given. Put the equation in standard form and sketch the ellipse.6x2 + (y + 2)2 = 6

A. x2 +  = 1

= 1

B.  + (y + 2)2 = 1

+ (y + 2)2 = 1

C. x2 +  = 1

= 1

D.  + (y + 2)2 = 1

+ (y + 2)2 = 1

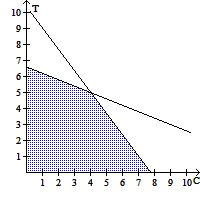

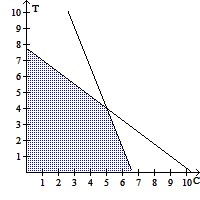

Solve the problem.A bakery plans to market a mixed assortment of its two most popular cookies: Chocolate Chip and Toffee Chunk. Their marketing analyst proposes that the new assortment be constrained by the inequality  where C is the number of Chocolate Chip cookies and T is the number of Toffee Chunk cookies. Their sales analyst suggests in order to offer a reasonably priced product the assortment should be constrained by the inequality

where C is the number of Chocolate Chip cookies and T is the number of Toffee Chunk cookies. Their sales analyst suggests in order to offer a reasonably priced product the assortment should be constrained by the inequality  The number of each type of cookie cannot be negative, so

The number of each type of cookie cannot be negative, so

alt="" style="vertical-align: -4.0px;" /> and  Graph the region satisfying all the requirements for the assortment using C as the horizontal axis and T as the vertical axis. Does the combination of 1 Chocolate Chip cookies and 7 Toffee Chunk cookies satisfy all of the requirements?

Graph the region satisfying all the requirements for the assortment using C as the horizontal axis and T as the vertical axis. Does the combination of 1 Chocolate Chip cookies and 7 Toffee Chunk cookies satisfy all of the requirements?

A.  ; No

; No

B.  ; No

; No

C.

; Yes

; Yes

D.  ; Yes

; Yes

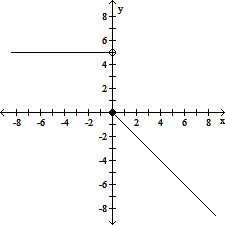

Find a formula for the function graphed.

A. f(x) =

B. f(x) =

C. f(x) =

D. f(x) =

Add or subtract as indicated. Simplify, if necessary.-  +

+

A.

B.

C. -

D. -