A ad valorem sales tax can be thought of as

A) a proportional tax.

B) not part of the tax base.

C) a revenue source for county governments only.

D) none of the above.

A

You might also like to view...

Most economists agree that the best rate of inflation for a stable economy would be around:

A. zero. B. two to three percent. C. five to six percent. D. seven percent.

Equity investors can choose to participate indirectly in real estate markets by purchasing shares in publicly traded real estate companies. In doing so, investors benefit from all of the following EXCEPT:

A. Low transaction costs B. Risk sharing amongst investors C. Highly segmented markets D. High information efficiency

In general, when the price of a variable factor of production increases:

A. the profit-maximizing price falls. B. total cost falls. C. the profit-maximizing level of output falls. D. the profit maximizing level of output rises.

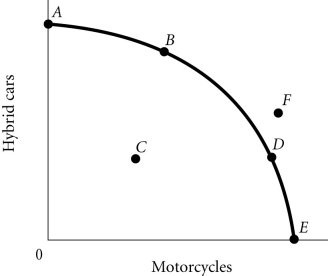

Refer to the information provided in Figure 2.4 below to answer the question(s) that follow. Figure 2.4According to Figure 2.4, an increase in unemployment may be represented by the movement from

Figure 2.4According to Figure 2.4, an increase in unemployment may be represented by the movement from

A. B to A. B. A to C. C. C to D. D. B to D.