Why would a higher tax rate lower the government purchases multiplier? What does the tax rate have to do with the government purchases multiplier?

What will be an ideal response?

The tax rate affects how much of the additional income that results from the initial increase in government purchases is available to be consumed. A higher tax rate decreases the amount of disposable income that can be consumed at each round of the multiplier process.

You might also like to view...

Brazil only exports coffee and its price is $15 . It only imports crackers and its price is $10 . Brazil's terms of trade is

a. 15 b. 150 c. 67 d. 167 e. 100

From 2008 to 2012 both U.S. saving and U.S. investment fell

a. True b. False Indicate whether the statement is true or false

Which of the following is not a determinant of autonomous consumption?

A. Taxes. B. The price level. C. The availability of credit. D. The disposable income level.

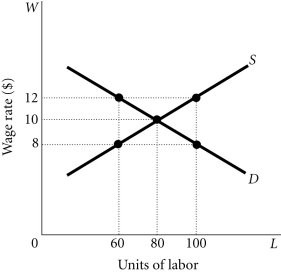

Refer to the information provided in Figure 28.3 below to answer the question(s) that follow. Figure 28.3Refer to Figure 28.3. In an attempt to increase worker productivity, this firm would pay wages ________ per hour.

Figure 28.3Refer to Figure 28.3. In an attempt to increase worker productivity, this firm would pay wages ________ per hour.

A. of $10 B. > $10 C. of $8 D. < $8