The payroll tax appears to be a proportional tax. In reality, it is

A. highly progressive.

B. actually proportional.

C. highly regressive.

D. regressive on low-income persons and progressive on high-income persons.

Answer: C

You might also like to view...

When large firms in oligopoly markets cut their prices

A) we don't know for sure how rival firms will respond. B) rival firms will also cut their prices to avoid losing sales. C) rival firms will not change their prices because most of their customers have signed contracts that commit them to doing business with the same firms for the life of their contracts. D) rival firms will not cut their prices because they fear that the federal government will accuse them of collusion.

Suppose a firm has total revenue of $200 million, explicit costs of $190 million, and implicit costs of $20 million. This firm's accounting profit is:

a. $80 million. b. $70 million. c. $10 million. d. ?$10 million.

The Organization of Petroleum Exporting Countries is an example of: a. a price leadership system

b. a trade group whose members have yet to influence the world price of oil, despite repeated attempts to collude. c. a successful monopoly. d. a periodically successful cartel.

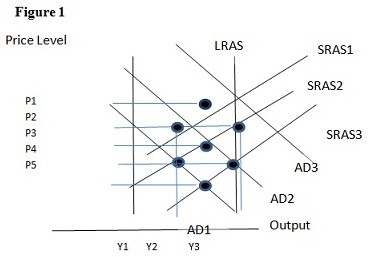

Using Figure 1 above, if the aggregate demand curve shifts from AD1 to AD2 the result in the short run would be:

A. P1 and Y2. B. P3 and Y1. C. P2 and Y2. D. P2 and Y3.