Which combination of circumstances will most likely raise the rate of interest for a loan the most?

A) low handling charges and low risk

B) low handling charges and a long length of time for repayment

C) high risk and low handling charges

D) high risk and a long length of time for repayment

Answer: D

You might also like to view...

Which of the following is LEAST likely to be a monopoly?

A) the holder of a public franchise B) a pharmaceutical company with a patent on a drug C) a store in a large shopping mall D) an artist who owns a copyright for a painting

Net exports ________

A) are heavily determined by foreign demand for domestic goods B) are heavily determined by domestic demand for domestic goods C) are independent of domestic interest rate fluctuations D) all of the above E) none of the above

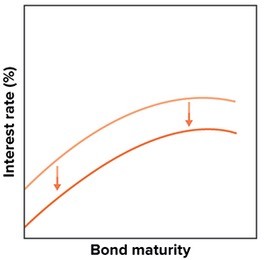

Which of the following would have the impact shown in the accompanying graph?

A. Precommitment policy B. Operation twist C. Quantitative easing D. Money easing

By the height of the housing bubble in 2005 and early 2006, lenders had greatly loosened the standards for obtaining a mortgage loan, with many mortgages being granted to sub-prime borrowers ________ and "Alt-A" borrowers ________

A) with flawed credit histories; who did not document their incomes B) who borrowed money at rates below the prime interest rate; who had AAA credit ratings C) who borrowed more than 120 percent of the value of the house; with no proof of U.S. citizenship D) who purchased homes in depressed housing markets; who purchased homes which were repossessed by government agencies.