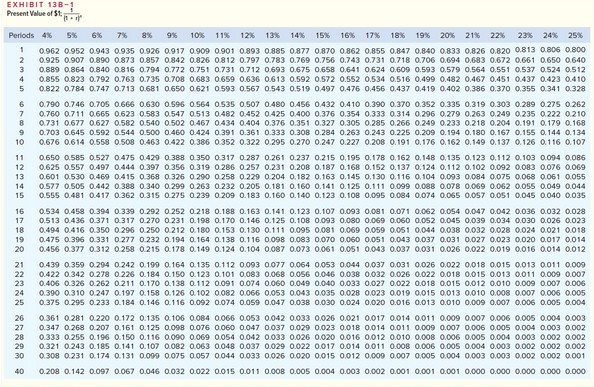

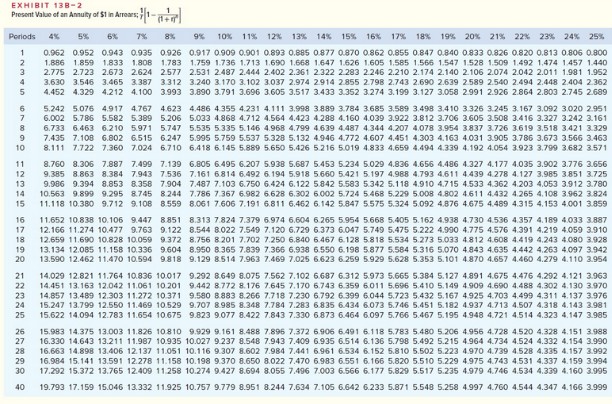

Joetz Corporation has gathered the following data on a proposed investment project (Ignore income taxes.): Investment required in equipment$36,500? Annual cash inflows $8600? Salvage value of equipment$0 Life of the investment 15yearsRequired rate of return 10%The company uses straight-line depreciation on all equipment. Assume cash flows occur uniformly throughout a year except for the initial investment. Use Exhibit 13B-1 and Exhibit 13B-2 above to determine the appropriate discount factor(s). The internal rate

Joetz Corporation has gathered the following data on a proposed investment project (Ignore income taxes.): Investment required in equipment$36,500? Annual cash inflows $8600? Salvage value of equipment$0 Life of the investment 15yearsRequired rate of return 10%The company uses straight-line depreciation on all equipment. Assume cash flows occur uniformly throughout a year except for the initial investment. Use Exhibit 13B-1 and Exhibit 13B-2 above to determine the appropriate discount factor(s). The internal rate

of return of the investment is closest to:

A. 26%

B. 22%

C. 20%

D. 24%

Answer: B

You might also like to view...

Which of the following approaches to defining publics identifies "knowledgeables" or "influentials" based on others' perceptions of these individuals?

A. Psychographics D. Position B. Reputation E. Role in the decision process C. Covert power

Writing in passive voice is more effective than writing in active voice

Indicate whether the statement is true or false

Effective meetings are a valuable use of the participants' time. _________________________

Answer the following statement true (T) or false (F)

When a depreciable asset is sold, a tax gain or tax loss on disposal is calculated, based on the book value of the asset at the time of disposal. If a ________ has occurred, a ________ is recorded

A) gain, tax credit B) gain, tax reduction C) loss, tax credit D) loss, tax increase