As a result of ________, the incomes of the top 1% of income earners during the 1970s were understated.

A. the rapid decrease in the proportion of Americans filing tax returns

B. the special tax treatment of capital gains

C. the increase in consumption levels

D. the expansion of the non-refundable ETIC

Answer: B

You might also like to view...

Suppose Joe can prepare 20 sandwiches or 10 pizzas in an hour and Beth can produce 36 sandwiches or 27 pizzas. The concept of comparative advantage concludes that

A) Beth should produce both goods because she can produce more of both goods in an hour than can Joe. B) Beth should produce sandwiches and Joe should produce pizza. C) Beth should produce pizza and Joe should produce sandwiches. D) Beth should produce both goods and Joe should produce sandwiches.

Economists generally believe that

a. buyers and sellers have all the information they can use b. additional information is costly to acquire c. decision makers have complete knowledge of all the alternatives available d. economic decisions result from random behavior e. decision makers never make mistakes

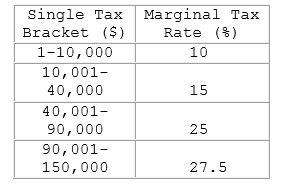

For a person earning $75,000, the average tax rate is:

A. 10%

B. 15%

C. 19%

D. 17%

When production of a good generates external costs, the

a. demand curve for the good will overstate the true social benefits from consumption of the good. b. demand curve for the good will understate the true social benefits from consumption of the good. c. supply curve for the good will overstate the true social cost of producing the good. d. supply curve for the good will understate the true social cost of producing the good.