Assume a bank has $200 million of assets with a duration of 2.5, and $190 million of liabilities with a duration of 1.05. The duration gap for this bank is

A) 0.5 year.

B) 1 year.

C) 1.5 years.

D) 2 years.

C

You might also like to view...

Accumulating a greater number of inputs will ensure that an economy will experience economic growth

Indicate whether the statement is true or false

Suppose capital and labor are perfect substitutes resulting in a production function of q = K + L. That is, the isoquants are straight lines with a slope of -1

Derive the long-run total cost function TC = C(q) when the wage rate is w and the rental rate on capital is r.

The existence of absolute advantage

A. implies that there will be no benefits from trade taking place between two nations. B. refers to a situation where one country can produce one particular good with fewer units of resources than the other country. C. fosters the self-sufficiency of the two nations. D. refers to a situation in which one country can produce all goods with fewer units of resources than can another country.

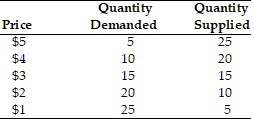

Using the above table, the market clearing price for this product is

Using the above table, the market clearing price for this product is

A. $5. B. $2. C. $4. D. $3.