When the real interest rate increases

A) the supply of loanable funds curve shifts rightward.

B) the supply of loanable funds curve shifts leftward.

C) there is a movement upward along the supply of loanable funds curve.

D) there is a movement downward along the supply of loanable funds curve.

C

You might also like to view...

The normal rate of return is the

A) average rate of return earned in an industry at a given point in time. B) opportunity cost of capital. C) return on capital associated with zero accounting profits. D) the amount paid to an investor when the firm is an on-going concern.

If Shoffner Inc., a publicly traded corporation, has a share price of $125, revenues of $15.35 per share, and profits of $5.25 per share, what is the P/E ratio for Shoffner Inc. shares?

A. 0.12. B. 0.04. C. 8.14. D. 23.81.

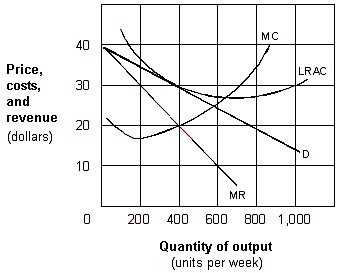

Exhibit 10-3 A monopolistic competitive firm in the long run

A. zero. B. $10 C. $20. D. $30.

If an agricultural market is perfectly competitive, then

A. Each firm's demand curve is perfectly inelastic. B. A farmer practices price discrimination. C. The market demand curve is perfectly elastic. D. A farmer is a price taker.