McClintock Co. had the following transactions involving plant assets during Year 1. Unless otherwise indicated, all transactions were for cash.

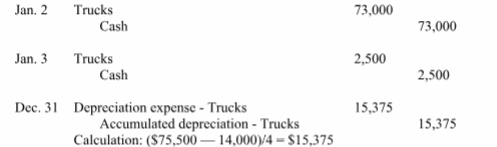

Jan. 2 Purchased a truck for $70,000 plus sales taxes of $3,000. The truck is expected to have a $14,000 salvage value and a 4 year life.

Jan. 3 Paid $2,500 to have the company's logo painted on the truck. This did not change the truck's salvage value.

Dec. 31 Recorded straight-line depreciation on the truck.

Prepare the general journal entries to record these transactions.

You might also like to view...

What is Houston's free cash flow for all debt and equity holders for year 2012?

a. $564 b. $399 c. $324 d. $202

Orange Inc. issued 20,000 nonqualified stock options valued at $40,000 (in total). The options vest over two years-half in 2019 (the year of issue) and half in 2020. One thousand options are exercised in 2020 with a bargain element on each option of $6. What is the 2020 book-tax difference associated with the stock options?

A. $24,000 favorable. B. $14,000 unfavorable. C. $24,000 unfavorable. D. $6,000 favorable. E. None of the choices are correct.

In Internet Explorer, the Security tab controls the website's pop-up blocker

Indicate whether the statement is true or false.

What is an e-mall?

A. Interactive business communities providing a central market space where multiple buyers and sellers can engage in e-business activities. B. Version of a retail store where customers can shop at any hour of the day without leaving their home or office. C. Serves as a gateway through which a visitor can access other e-shops. D. None of the above.