An alternative approach is to raise taxes on gasoline and other fuels. What is the economic intuition of this policy?

To promote cleaner air, the federal government in the United States enacted tax incentives for purchasing new electric vehicles or clean-fuel vehicles. These were scheduled to be phased out over time.

The tax on gasoline is a product charge. Its intent is to internalize the negative externality of gasoline consumption. Intuitively, such a policy instrument changes relative prices, in this case between gasoline and alternative fuels. As the effective price of gasoline rises with the tax, quantity demanded falls, ceteris paribus. Quantity falls because consumers rationally move away from the relatively expensive good, gasoline, and move toward gasoline substitutes, i.e., alternative fuels.

You might also like to view...

What happens to M1 and M2 due to each of the following changes?

(a) You take $500 out of your checking account and put it into a passbook savings account. (b) You take $1000 out of your checking account and buy traveler's checks. (c) You take $1500 out of your money—market mutual fund and deposit into your checking account. (d) You cash in $2000 in savings bonds and invest the money in a certificate of deposit.

Goods and services are exchanged in

a. product markets b. resource markets c. inventory markets d. classified markets e. government markets

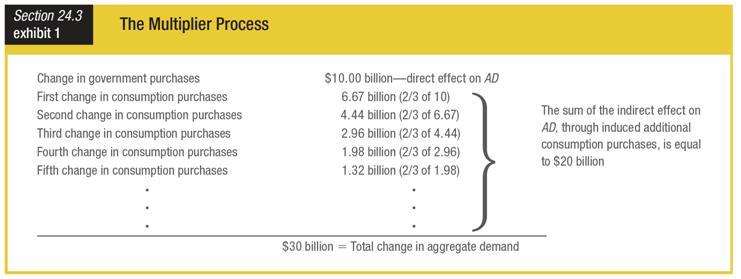

Based on the table, the increase in government purchases changes aggregate demand ______.

a. less than the combined changes in consumption purchases

b. more than the combined changes in consumption purchases

c. the same amount as the combined changes in consumption purchases

d. the same amount as the first individual round of consumption purchases

Refer to the information provided in Table 13.1 below to answer the question(s) that follow. Table 13.1Price ($)Quantity4.002,0003.502,4003.002,8002.503,2002.003,6001.504,0001.004,400Refer to Table 13.1. If a monopoly faces the demand schedule given in the table, what is its marginal revenue from the 4,000th unit it sells?

A. -$3 B. $1.50 C. $3 D. $1,200