A stock has an annual dividend of $10.00 and it is expected not to grow. It is believed the stock will sell for $100 one year from now, and an investor has a discount (interest) rate of 6% (0.06). The dividend discount model predicts the stock's current price should be:

A. $103.77

B. $94.67

C. $106.60

D. $116.00

Answer: A

You might also like to view...

Are jobs the key to economic progress and the achievement of high income levels?

a. Yes, as long as people are working, real income levels will be high. b. Yes, when full employment is present, income levels will be at their maximum. c. No, it is not just employment, but employment that expands production of goods and services that others value highly relative to cost. d. Uncertain, additional employment will increase real income only when the general level of prices is unchanged.

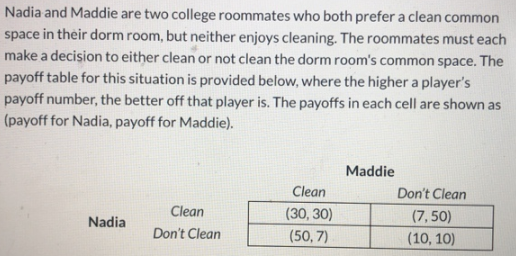

Refer to Table 17-20. If Maddie chooses not to clean, then Nadia will

a. clean and Maddie's payoff will be 50.

b. clean and Maddie's payoff will be 30.

c. not clean and Maddie's payoff will be 7.

d. not clean and Maddie's payoff will be 10.

The expected inflation rate is equal to the actual inflation rate. According to the (Friedman) natural rate theory, the economy is

A) in a recessionary gap. B) in an inflationary gap. C) at a point on the short-run Phillips curve, but not on the long-run Phillips curve. D) biased toward producing a higher percentage of services than goods. E) producing Natural Real GDP.

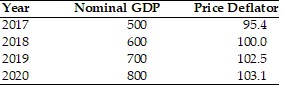

Refer to the above table. Real GDP in 2017 is

Refer to the above table. Real GDP in 2017 is

A. 500. B. 190.8. C. 524.1. D. 477.