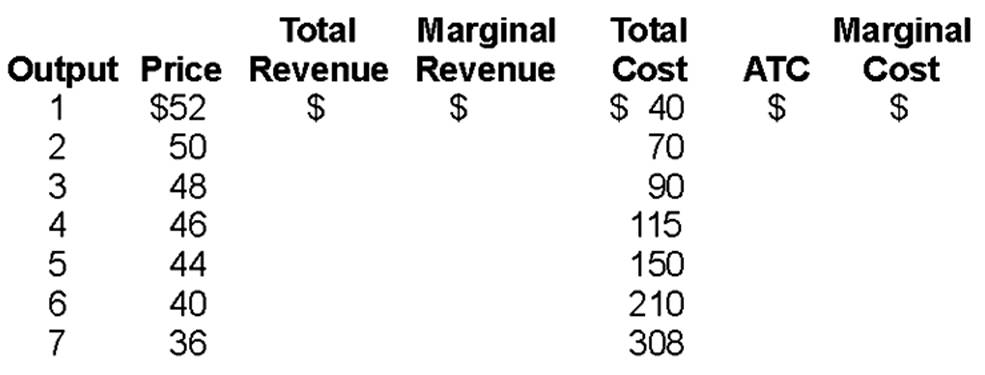

If the firm were a perfect competitor in the long run, what price would it charge?

$28.50

You might also like to view...

A study by the Congressional Budget Office (CBO) regarding the corporate income tax included the following statement: "A corporation may write its check to the Internal Revenue Service for payment of the corporate income tax, but the money must come

from somewhere..." The comments that followed this statement argued that A) corporations pass on some of the burden of the tax to investors in the company, to workers, and to consumers. B) it is necessary to retain the tax because it is based on the ability-to-pay principle. C) the corporate income tax is a reliable source of revenue because corporations cannot avoid paying the tax. D) the tax is more progressive than the individual income tax.

What are the advantages and disadvantages of resource allocation under monopolistic competition compared to perfect competition?

The market value of all domestically produced final goods and services are also equal to the total amount spent by ________ less spending on imported goods and services.

A. households, firms, and the foreign sector B. households and firms C. households, firms, governments, and the foreign sector D. households, firms, and governments

Capital inflows in the form of direct investment can provide ________; this is a ________ of capital inflows

A) access to political power; cost B) access to political power; benefit C) increases in external debt; cost D) decreases in external debt; benefit