Refer to the above figure. Suppose the marginal benefit and the marginal cost curves of pollution abatement are normally shaped. Suppose the equilibrium is for a factory in Los Angeles

What would happen if the same factory were in the middle of Nevada? A) The marginal cost curve (1 ) would shift to (2 ) and there would be no difference in the level of abatement.

B) The marginal cost curve (2 ) would shift to the left and there would be less abatement in Nevada.

C) The marginal benefit curve (4 ) would shift to the left and there would be less abatement in Nevada.

D) The marginal benefit curve (2 ) would shift to the right and there would be more abatement in Nevada.

C

You might also like to view...

The typical family on the Planet Econ consumes 10 pizzas, 7 pairs of jeans, and 20 gallons of milk. In 2016, pizzas cost $10 each, jeans cost $40 per pair, and milk cost $3 per gallon. In 2017, the price of pizzas went down to $8 each, while the prices of jeans and milk remained the same. Between 2016 and 2017, a typical family's cost of living:

A. remained the same. B. decreased by 20 percent. C. increased by 4.5 percent. D. decreased by 4.5 percent.

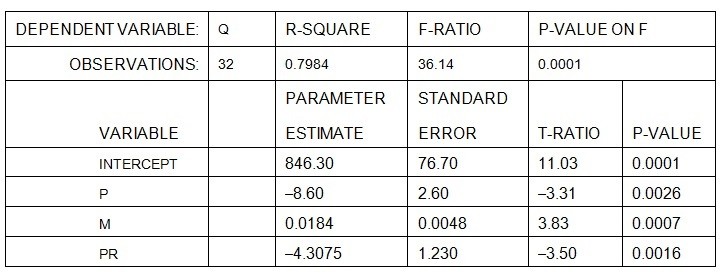

The following linear demand specification is estimated for Conlan Enterprises, a price-setting firm:Q = a + bP +cM +dPRwhere Q is the quantity demanded of the product Conlan Enterprises sells, P is the price of that product, M is income, and PR is the price of a related product. The results of the estimation are presented below:  Given the above, at the 1% level of significance, which estimates are statistically significant?

Given the above, at the 1% level of significance, which estimates are statistically significant?

A. Only a?, b, and c? are statistically significant B. All are statistically significant C. Only a? is statistically significant D. All but a? are statistically significant E. All but b and d are statistically significant

Which of the following statements is true?

A. Discrimination against women and blacks reduces the demand for these workers resulting in lower wages paid these workers. B. Discrimination is no longer a problem in the United States. C. A negative income tax system is a plan where everyone pays the same percentage of their income as taxes. D. A negative income tax system is a plan where those below a certain income receive a cash payment from government.

Many state lotteries have advertised "instant millionaire" lottery games. However, if one wins the game, the state does not write a check for a million dollars. Rather it pays $50,000 a year for 20 years. Using the tables shown and assuming the interest rate is 4, which of the following statements must be true?Annuity Table(value now of $1 Per year To be received for x-years) Present Value Table(Value now to $1 to be received x-years un the future) Year3%4%6%Year3%4%6%108.538.117.36100.740.680.531511.9411.129.71150.640.560.422014.8813.5911.47200.550.460.313019.6017.2913.76300.410.310.17

A. If the winner invests his annual payout, at the end of 20 years he will have a lot more than a million dollars. Hence the state is understating the winnings when it advertises these games as "instant millionaire." B. The true value of winning is much less than a million. The state has misrepresented the true value of the payout. C. The state does not care whether it gives a million as a lump sum or spread over 20 years. D. Since the winner will be given actually a million dollars over 20 years, the state is correct in advertising these games as "instant millionaire."