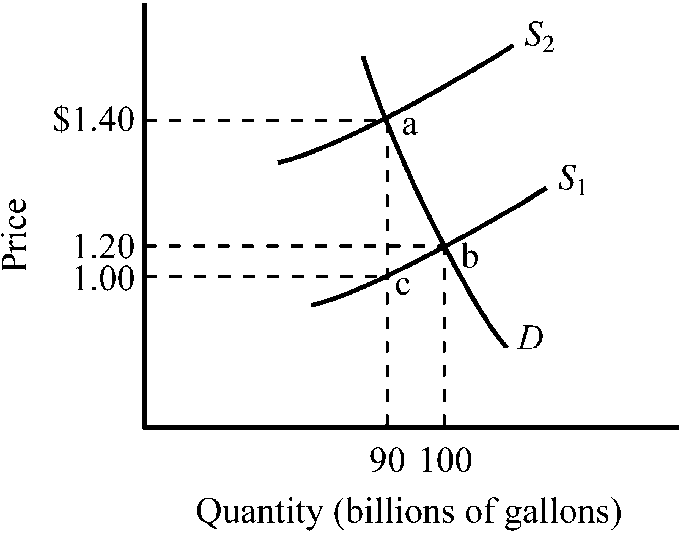

Figure 4-9

Refer to . The market for gasoline was initially in equilibrium at point b. If a $.40 excise tax was imposed,

a.

the supply of gasoline would shift to S2.

b.

the price of gasoline to consumers would increase from $1.20 per gallon to $1.40 per gallon.

c.

the net price received by producers of gasoline would decline from $1.20 per gallon to $1.00 per gallon.

d.

all of the above would occur.

d

You might also like to view...

Any output combination outside a production possibilities frontier is associated with unused or

underutilized resources. Indicate whether the statement is true or false

Two firms, Kegareta Inc. and Sucio Enterprises, have access to five production processes, each one of which has a different cost and gives off a different amount of pollution. The daily costs of the processes and the corresponding number of tons of smoke emitted are shown in the accompanying table. ABCDE 4 tons/day3 tons/day2 tons/day1 tons/day0 tons/dayKegareta Inc.$40$85$135$190$250Sucio Enterprises$120$175$250$345$460 Suppose the government wants to reduce pollution by 50 percent by imposing a tax of $T per day on each ton of smoke emitted. Of the options listed, what's the smallest tax, $T, that will achieve this goal?

A. $51 B. $61 C. $56 D. $54

Public goods face the

A) principle of rival consumption. B) free-rider problem. C) law of overproduction. D) exclusion principle.

Since a monopolistically competitive firm has a monopoly over the particular product it produces, the firm is guaranteed a profit in the long run.

Answer the following statement true (T) or false (F)