A coupon bond has an annual coupon of $75, a par value of $1000, and a market price of $900. Its current yield equals

A) 7.50%.

B) 8.33%.

C) its yield to maturity.

D) Not enough information has been provided to calculate the current yield for this bond.

B

You might also like to view...

If other factors are held constant, an increase in the price level

A) causes desired net export spending to rise. B) causes the real value of the money to increase. C) causes desired net export spending to fall. D) induces people to spend their money faster.

If average total cost is $50 and average fixed cost is $15 when output is 20 units, then the firm's total variable cost at that level of output is

A) $1,000. B) $700. C) $300. D) impossible to determine without additional information.

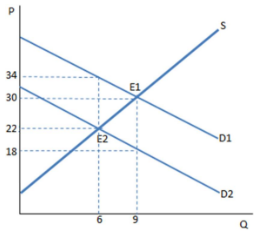

The graph shown demonstrates a tax on buyers. Before the tax was imposed, the buyers purchased ____ units and paid _____ for each one.

A. 6; $22

B. 6; $34

C. 9; $18

D. 9; $30

What are specific assets?