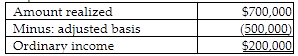

Allen contributed land, which was being held for sale to Allen's customers, to a partnership in exchange for a 20% interest. The partnership uses the land in its business for three years and then sells the property. When the property was contributed, it had a basis in Allen's hands of $500,000 and an FMV of $600,000. The partnership sells the land for $700,000. The gain reported by the

partnership is

A) $100,000 of ordinary income and $100,000 of Sec. 1231 gain.

B) $100,000 of Sec. 1231 gain and $100,000 of capital gain.

C) $200,000 of ordinary income.

D) $200,000 of Sec. 1231 gain.

C) $200,000 of ordinary income.

Land, which is held as inventory by Allen, retains its character as inventory in the hands of the partnership for five years after the contribution.

You might also like to view...

Briefly define an operating system

Increasingly, organizations are restricting the use of their e-mail systems for business use only

Indicate whether the statement is true or false.

Which of the following is not a condition of a discrete probability distribution?

A) Each outcome in the distribution needs to be mutually exclusive with other outcomes in the distribution. B) The probability of a success must exceed the probability of a failure. C) The probability of each outcome, P(x), must be between 0 and 1 (inclusive). D) The sum of the probabilities for all the outcomes in the distribution needs to add up to 1.

Which of the following is not a key change in the business environment since the 1970s?

A. Increased sophistication of technology B. More highly educated workers C. Greater stability in consumer tastes and preferences D. Greater demand for high-quality goods and services