Suppose someone offered to give you $1,000,000 five years in the future and the anticipated interest rate is 5 percent. The present value of this offer would be worth approximately

A) $784,000.

B) $500,000.

C) $1,050,000.

D) $286,000.

Answer: A

You might also like to view...

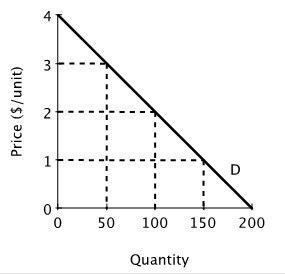

Suppose Acme and Mega produce and sell identical products and face zero marginal and average cost. Below is the market demand curve for their product.  If Acme and Mega decide to collude and work together as a monopolist with each firm producing half the quantity demanded by the market at the monopoly price, then what will be Mega's economic profit?

If Acme and Mega decide to collude and work together as a monopolist with each firm producing half the quantity demanded by the market at the monopoly price, then what will be Mega's economic profit?

A. $150 B. $100 C. $50 D. $0

What is the shape of a firm's marginal revenue product curve? Why does it look this way?

What will be an ideal response?

Suppose the price of X increases by 10 percent while the quantity demanded of Y does not change. We would conclude that

A) the two goods are substitutes, but the cross elasticity of demand is not large. B) the two goods are complements, but the cross elasticity of demand is not large. C) the two goods are perfect substitutes. D) the two goods are not related.

Keynesian policy suggests that if inflationary rises in the price level are a concern, the response would be contractionary fiscal policy, using tax increases or government spending cuts to shift AD to the left. What would the result be in this scenario?

a. The result would be downward pressure on the price level, very little reduction in output but a large rise in unemployment. b. The result would be downward pressure on the price level, but very little reduction in output or very little rise in unemployment. c. The result would be downward pressure on the price level, a large reduction in output but very little rise in unemployment. d. The result would be downward pressure on the price level, but a large reduction in output and a large rise in unemployment.