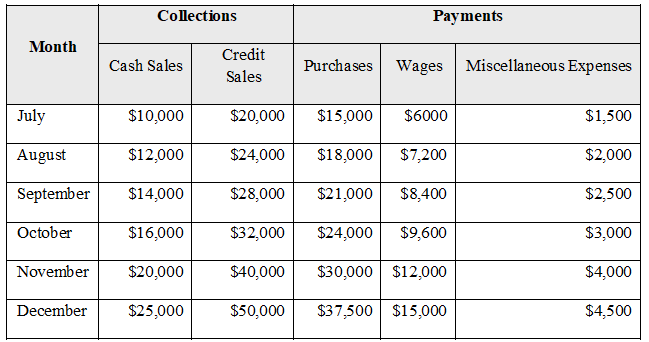

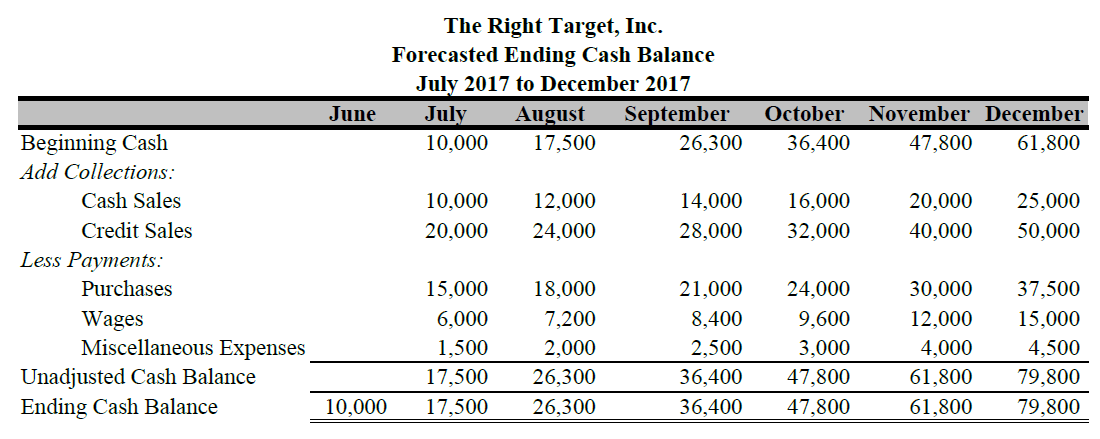

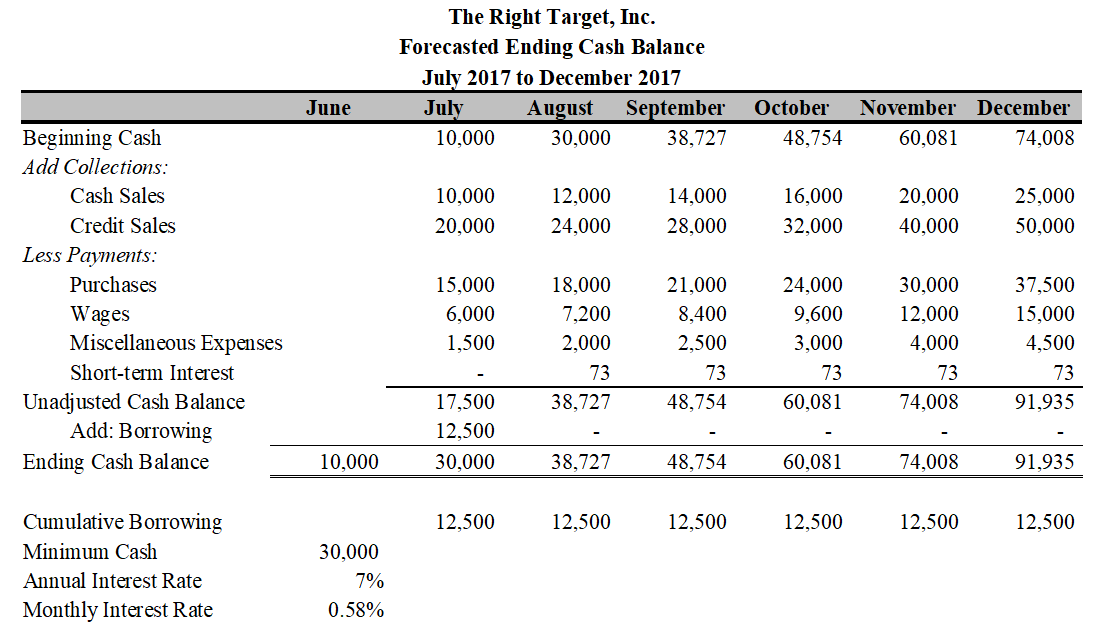

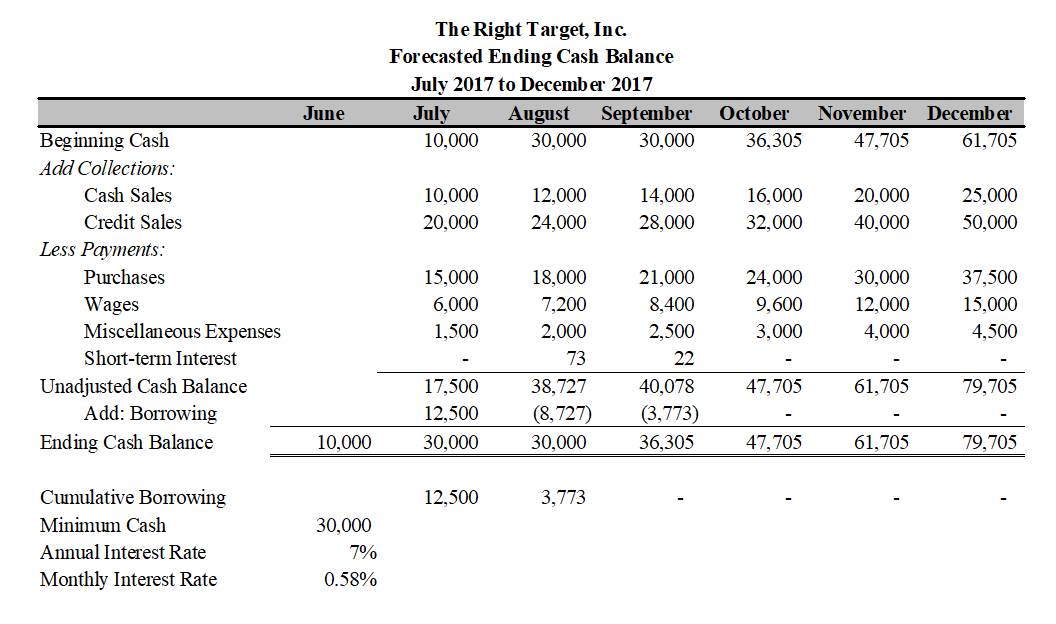

The Right Target, Inc., a marketing research and consulting firm, is working on a cash budget for July to December 2017. The staff has projected the following cash collections and payments:

a) If the ending cash balance as of June 30, 2017 was $10,000, determine the firm’s forecasted monthly cash balance.

b) The staff at The Right Target, Inc. wants to know how much they would need to borrow each month if the minimum ending cash balance is $30,000 and the annual interest rate is 7%.

c) Determine the impact on the ending cash balance if the firm uses any cash surplus above the required minimum cash balance to pay off its short-term borrowing monthly.

You might also like to view...

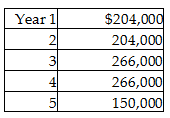

Considering the residual value is zero, calculate the payback period. (Round your answer to two decimal places.)

First Choice Carpets is considering purchasing new weaving equipment costing $730,000. The company's management has estimated that the equipment will generate cash inflows as follows:

A) 4.61 years

B) 3.21 years

C) 3.42 years

D) 3.70 years

With a single-server model, increasing the capital-to-labor ratio will most likely:

A) increase the utilization of the server. B) have no effect on the operating characteristics because they are affected only by work-methods changes. C) decrease the probability that there are zero customers in the system at any time. D) decrease the average number of customers in the waiting line.

The case Henningsen v. Bloomfield Motors, had a major impact on the application of tort law to foreign producers

a. True b. False Indicate whether the statement is true or false

Use the information in the adjusted trial balance presented below to calculate current assets for Taron Company: Account TitleDr CrCash$74,000? Accounts receivable 33,000? Prepaid insurance 13,400? Equipment 270,000? Accumulated depreciation-Equipment $135,000? Land 112,000? Accounts payable 34,000? Interest payable 6650? Unearned revenue 10,100? Long-term notes payable 81,000? Z. Taron, Capital 235,650? Totals$502,400? $502,400?

A. $120,400. B. $41,200. C. $34,000. D. $112,000. E. $502,400.