In what sense does the IMF act as a lender of last resort? How might the IMF's actions during the Mexican crisis of the mid-1990s have contributed to the Asian currency crisis a few years later?

What will be an ideal response?

The IMF acts as an international lender of last resort in the sense of making short-term loans to governments that lack the international reserves necessary to support the exchange value of their currencies. Some economists argue that the existence of the IMF introduces significant moral hazard into the international financial system. Some argue that the IMF's bailout of foreign lenders during the Mexican crisis encouraged risky lending to East Asian countries, which contributed to the Asian currency crisis.

You might also like to view...

Refer to Figure 13-11. The diagram depicts a firm

A) in an increasing-cost industry. B) in long-run equilibrium. C) that is making short-run losses. D) in a constant-cost industry.

An import quota is a

a. tax on imports b. legal limit on the amount of a specific good that can be imported into a particular country c. tax on import quantities above the legal limit d. way to increase tariff revenues e. legal incentive for members of GATT to increase their exports of a particular good

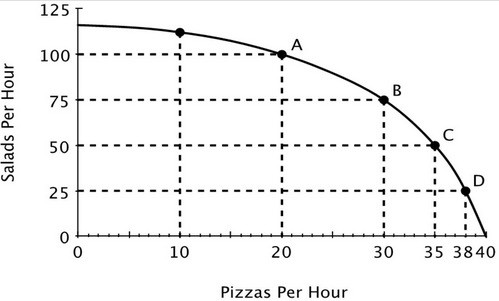

Refer to the accompanying figure. Moving from point C to point B, the opportunity cost of 25 more salads is:

A. 10 pizzas. B. 5 pizzas. C. 30 pizzas. D. 15 pizzas.

An increase in the price level results in a(n) ________ in the quantity of real GDP demanded because ________

A) decrease; a higher price level reduces consumption, investment, and net exports. B) increase; a higher price level reduces consumption, investment, and net exports. C) decrease; a higher price level increases consumption, investment, and net exports. D) increase; a higher price level increases consumption, investment, and net exports.